分析 :

Sapcrest 宣布购买50% Labuan Shipyard and Engineering Sdn Bhd (LSE) , 一家著名东南亚里面设备齐全的船厂, 进军船坞业务. LSE据传将得到 PETRONAS fabrication license , 如属实将对sapcrest未来业务带来正面效益。 除此之外, SAPCREST还没有正式发布通知将要买进2艘新船 pipe lay barges.

目前21倍 PE , P/B ratio 4.5倍 -- 我觉得有点高 ,但是前景不错

收购的价格目前还没有透露。 以目前8.6Billion 的订单,Target Price 将设定在 RM4.20 (18x PE, EPS (23.4 sen) )

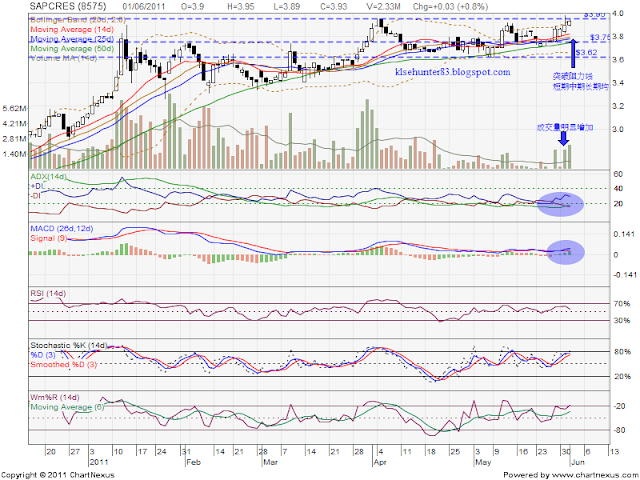

如果可以保持成价格3.95新高以上以及高交量,将会突破Rm4.00, 止损点 RM3.75近期低点

前提是, 有成交量支撑 不然就是假突破。

Key financial data

FYE 31 Jan FY11 FY12F FY13F FY14F

Adj EPS (sen) 18.1 23.9 27.2 31.9

Adj P/E (x) 21.7 16.5 14.5 12.3

Net DPS (sen) 8.5 9.5 10.9 15.9

Div yield (%) 2.2 2.4 2.8 4.1

BVPS (RM) 0.87 1.02 1.19 1.35

P/B (x) 4.5 3.8 3.3 2.9

| Fiscal Year | 1/31/2008 | 1/31/2009 | 1/31/2010 |

| ISO Currency | MYR ('000) | MYR ('000) | MYR ('000) |

| Report Type | C | C | C |

| INCOME STATEMENT | |||

| Net Turnover/Net Sales | 2,261,905 | 3,451,702 | 3,257,043 |

| EBITDA | 325,241 | 458,437 | 477,037 |

| EBIT | 232,688 | 332,647 | 434,585 |

| Net Profit | 78,264 | 115,774 | 172,035 |

| Ordinary Dividend | 0 | -23,770 | -38,302 |

| BALANCE SHEET | |||

| Intangibles | 145,994 | 149,515 | 149,314 |

| Fixed Assets | 876,294 | 903,559 | 900,456 |

| Long Term Investments | 154,279 | 105,508 | 192,107 |

| Stocks/Inventories | 57,373 | 50,023 | 54,276 |

| Cash | 354,209 | 593,538 | 875,251 |

| Current Liabilities | 1,383,358 | 1,744,905 | 1,473,121 |

| Long Term Debt | 268,954 | 207,348 | 158,135 |

| Provisions | 0 | 0 | 0 |

| Minorities | 272,165 | 401,197 | 397,103 |

| Total Shareholders Equity | 796,473 | 922,390 | 1,063,217 |

| KEY RATIOS | |||

| Operating Margin | 11.01 | 9.83 | 12.56 |

| Return on Equity Capital | 12.69 | 13.47 | 17.33 |

| Net Profit Margin | 3.46 | 3.35 | 5.28 |

| Current Ratio | 1.3 | 1.35 | 1.42 |

| Debt to Capital at Book | 0.35 | 0.26 | 0.21 |

No comments:

Post a Comment